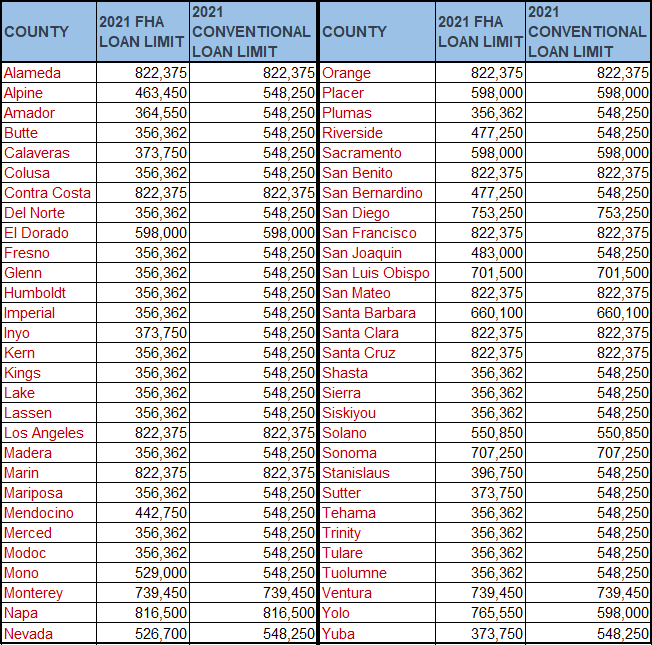

California FHA vs. Conventional High-Balance Loan Limits 2021

Since we do 90% of our business in California. let’s talk more about California in this section. Here are the 2021 Conforming limits for all 58 counties in California for 1 unit.

What Is A High-Balance Mortgage Loan?

Before we go any further, let’s define what a high-balance mortgage is. A high–balance loan is basically a conforming loan that is higher than the current conforming loan limit ($548,000 in 2021), and no more than the $822,000 limit for high-cost areas. Today, high–balance loans allow up to a 95% LTV for a fixed-rate loan, or a 90% LTV for an adjustable-rate mortgage

Most mortgages in the U.S. are conforming loans that are based on what two large, government-sponsored entities (GSEs), Fannie Mae and Freddie Mac, are willing to buy from lenders and resell to investors on Wall Street as mortgage-backed securities.

Fannie Mae and Freddie Mac guarantee the mortgages they sell, so they’re a stabilizing influence in the mortgage market. However, these two companies — which are actually private — also set limits on what they will buy, and these limits are first determined by the FHFA.

As mentioned above, in 2021, the maximum conforming loan limit for high-cost areas for a one-unit home in the United States is now $822,000 up from $765,000 in 2020, for high-cost areas in the continental USA as well as Hawaii, Alaska, Guam, and the US Virgin Islands.

High-balance loans typically come with tighter requirements than regular conforming loans. Interest rates also tend to be higher than for conforming loans because you’re asking for more money, so the loan carries more risk for a lender.

Still, it’s easier to get a high-balance loan now than it used to be. In the past, borrowers typically had to bring a 5% down payment to closing if a high-balance loan had an 80% loan-to-value ratio (LTV) or more. Today, high-balance loans allow up to a 95% LTV for a fixed-rate loan, or a 90% LTV for an adjustable-rate mortgage.

You can use a high-balance mortgage loan to buy a home, for a limited cash-out refinance, or for a cash-out refinance. They apply to either fixed-rate or adjustable-rate mortgages, and also to condominiums, cooperative apartments, and manufactured homes that have between one and four units. While eligibility for a high-balance loan is subject to a minimum 620 credit score, if you have a higher credit score you may be able to get a loan that comes with a higher debt-to-income ratio.